No matter what the circumstances, we strive to protect our family and loved ones from all sorts of danger. We want to protect them, and ensure they are financially stable when we’re no longer there to support them. With life insurance, you can do that. However, what if age and health problems, or even the lack of time get in the way, but you still want to protect your loved ones? What’s the solution to that? Well then, we believe that here at Xeed, we can help you by providing you the option of no medical exam life insurance.

No matter what the circumstances, we strive to protect our family and loved ones from all sorts of danger. We want to protect them, and ensure they are financially stable when we’re no longer there to support them. With life insurance, you can do that. However, what if age and health problems, or even the lack of time get in the way, but you still want to protect your loved ones? What’s the solution to that? Well then, we believe that here at Xeed, we can help you by providing you the option of no medical exam life insurance.

With no medical exam life insurance, you are able to protect you and your family quickly—without all the medical exams.

Getting Life Insurance with a Pre-existing Conditions:

- Cancer

- COPD

- Diabetes

- Depression

- HIV

- Heart Disease

- Hepatitis

- Kidney Disease

- Neurological Conditions

- Stroke

Fully underwritten policies:

- These policies require a full application and is reviewed by an insurance company underwriter before a policy is issued.

- Note: Some companies have policies that don’t require a physical medical test for smaller face amounts (i.e. less than $250,000).

Simplified Issue policies:

- Simplified issue policies don’t require any physical evidence, and only feature a limited amount of very vague medical questions. However, your answers for all the questions must be ‘no’ in order to qualify.

- Simplified issue policies have higher premiums than and can also have reduced benefits. However, with the ease of the application and very broad medical questions, it is suitable for those who have medical conditions that prevent them from a fully underwritten policy. It is also appropriate for individuals who are just looking for an easy and straightforward application process.

- Guaranteed Issue policies:

- With a guaranteed issue policie, you can obtain coverage with a simple cheque and signature, as there are no medical exams or medical questions required.

- However, guaranteed issue policies have reduced benefits and increased premiums compared to the various other products.

- These policies are suitable for individuals who can’t qualify for simplified issue policies.

Obviously, you want to protect your family and not leave any burden on them after death, that’s why we have term life insurance.

Obviously, you want to protect your family and not leave any burden on them after death, that’s why we have term life insurance.

When you have a family, your number one concern is protecting them from all types of harm, whether that be physical, financial or just absolutely anything, you want to make sure they’re safe. That’s why we have life insurance. We know and understand that your main concern is keeping your family safe, and here at Xeed, we want to help you find the best life insurance within your budget to do just that.

When you have a family, your number one concern is protecting them from all types of harm, whether that be physical, financial or just absolutely anything, you want to make sure they’re safe. That’s why we have life insurance. We know and understand that your main concern is keeping your family safe, and here at Xeed, we want to help you find the best life insurance within your budget to do just that. For many families, a home is one of the most valuable purchases they will ever make, and buying a home is also one of the main reason’s families invest in life insurance. Mortgage insurance, one of the types of life insurance, is an advisable investment as it ensures that your home remains within your family’s possession, as well as ensures that they have the required financial tools to pay bills and have a safety net, in case you are no longer there to earn an income and provide.

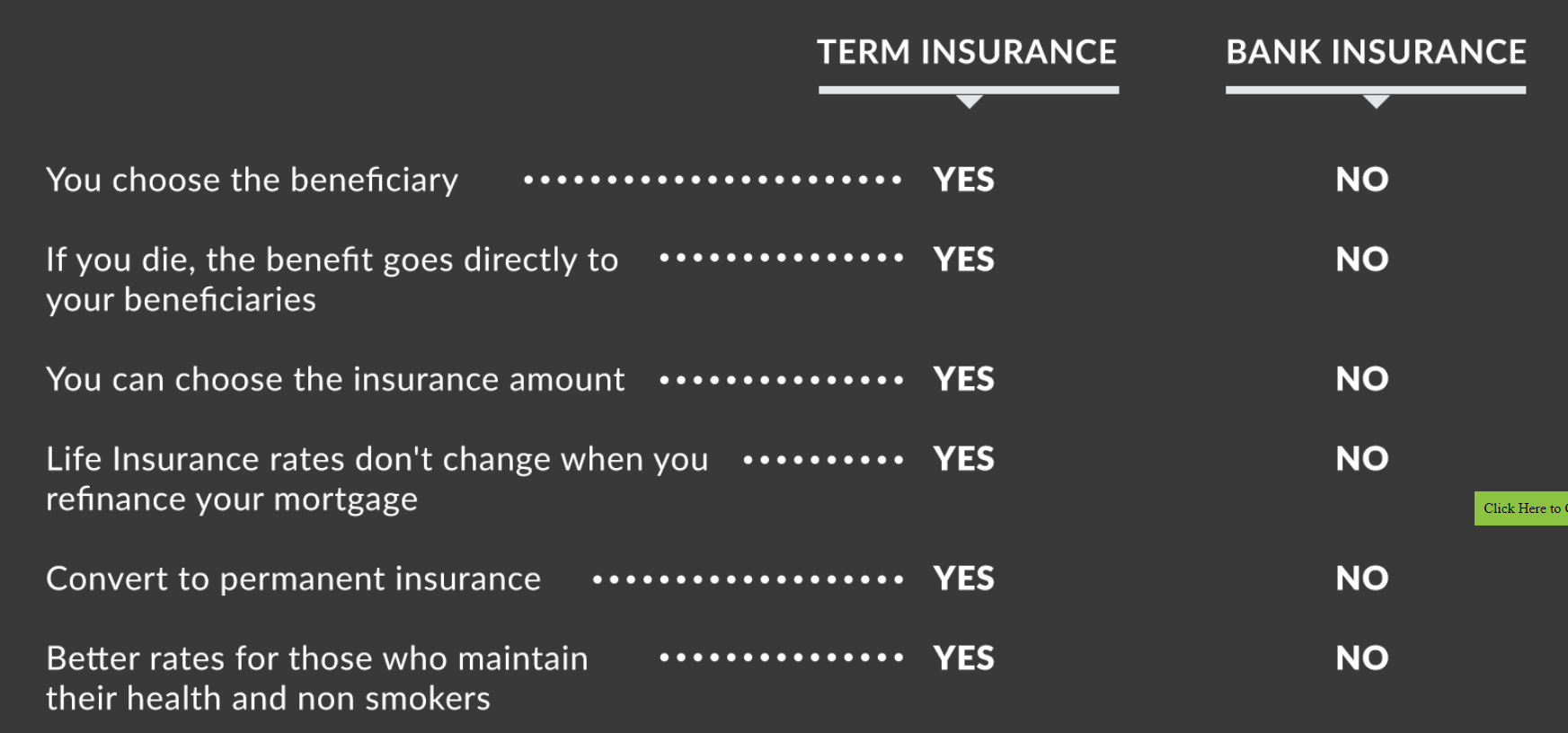

For many families, a home is one of the most valuable purchases they will ever make, and buying a home is also one of the main reason’s families invest in life insurance. Mortgage insurance, one of the types of life insurance, is an advisable investment as it ensures that your home remains within your family’s possession, as well as ensures that they have the required financial tools to pay bills and have a safety net, in case you are no longer there to earn an income and provide.

With financial obligations, that will remain with you for your entire life, it is important to have a long-term plan in place to protect both yourself and your family. Permanent life insurance does exactly that, it protects you for your lifetime.

With financial obligations, that will remain with you for your entire life, it is important to have a long-term plan in place to protect both yourself and your family. Permanent life insurance does exactly that, it protects you for your lifetime. No matter what the circumstances, we strive to protect our family and loved ones from all sorts of danger. We want to protect them, and ensure they are financially stable when we’re no longer there to support them. With life insurance, you can do that. However, what if age and health problems, or even the lack of time get in the way, but you still want to protect your loved ones? What’s the solution to that? Well then, we believe that here at Xeed, we can help you by providing you the option of no medical exam life insurance.

No matter what the circumstances, we strive to protect our family and loved ones from all sorts of danger. We want to protect them, and ensure they are financially stable when we’re no longer there to support them. With life insurance, you can do that. However, what if age and health problems, or even the lack of time get in the way, but you still want to protect your loved ones? What’s the solution to that? Well then, we believe that here at Xeed, we can help you by providing you the option of no medical exam life insurance. Final expense/funeral insurance is designed to pay your beneficiary a benefit amount that is set, if you were to die due to any reason. This insurance provides coverage for Canadian residents anywhere from the age of 18 to 74. Furthermore, there are no medical exams or health questions required to qualify for coverage, and the policy is sustainable until the age of 100.

Final expense/funeral insurance is designed to pay your beneficiary a benefit amount that is set, if you were to die due to any reason. This insurance provides coverage for Canadian residents anywhere from the age of 18 to 74. Furthermore, there are no medical exams or health questions required to qualify for coverage, and the policy is sustainable until the age of 100.